RICS supports the Prague Research Forum.

Offer office buildings

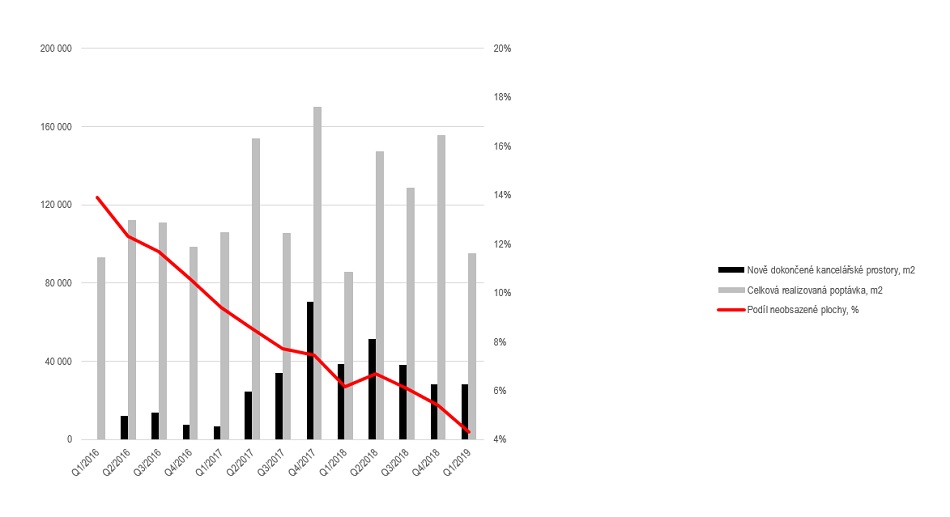

A total of 28,100 m 2 of office space was completed in Prague during the first quarter of 2019 , bringing the total volume of modern offices to 3.51 million m 2 . The newly completed premises include two new projects: Rustonka R3 in Prague 8 with 12,900 m 2 of office space and Churchill I in Prague 2 with 15,200 m 2 .

Rustonka

During the first quarter, the reconstruction of one office project, BB Centrum B, in Prague 4 (14,200 m 2 ) began . Currently, some 337,200 m 2 of modern office space is under construction , of which 172,500 m 2 is planned to be completed this year. The remaining areas are scheduled to be completed in 2020 and 2021.

Class A buildings make up the majority of modern office offerings (72%), with a share of the highest-quality AAA-rated offices in less than 22%.

Realized demand

Total gross realized demand (including renewed contracts - so-called renegotiations - and subleases) reached 95,200 m 2 in the first quarter of 2019 , representing a 41% quarter-on-quarter decline and a 16% year-on-year increase.

The highest demand in Q1 was recorded in Prague 8 (33.3%), Prague 4 (27.2%) and Prague 1 (17.2%). The most active companies were IT companies (23.0%), followed by professional services (17.0%) and flexible offices (12.1%). The share of renegotiations in total demand reached 25.9%, while the total size of newly leased space, pre-leases and expansions accounted for 74.1% of total demand.

Significant leases

The largest transaction in the first quarter of 2019 was pre-lease in Veeam Software's Rustonka R3 project (8,600 m 2 ), followed by a new lease of Spaces in Nile House (3,600 m 2 ).

Share of unoccupied area

The share of vacant office space in the total supply fell to 4.3% in the first quarter, down by 0.8 percentage point compared to the revised end-2018 results. The total volume of free offices reached 152,600 m 2 . The largest volume of available offices was in Prague 5 with 39,300 m 2 , which is a vacancy rate of 6.5%, followed by Prague 4 with 36,000 m 2 and vacancy rate of 3.8%. The lowest number of vacancies was in Prague 3 with 2,600 m 2 (vacancy rate 2.1%) and Prague 10 with 4,300 m 2 (3.1%).

Rent

Declining vacancy rates continue to put pressure on moderate rents. The highest first quarter rents were in the range of 22.00 to 22.50 EUR per m 2 per month in the city center, 15.00 to 16.50 € per m 2per month in the indoor and 13.50 to 15 EUR 00 per m 2 per month in the outside of the city.

Source / photo: www.retrend.cz / CBRE sro / Title photo PASSERINVEST GROUP, as - BB Centrum - Building A