The Czech Commercial Real Estate Market: A Powerhouse of Opportunity

The Czech Republic's commercial real estate market is demonstrating remarkable resilience and growth, making it an attractive destination for businesses looking for new premises. In 2025, the market saw an estimated total investment volume approaching 4 billion euros, solidifying Prague's position as a top global investment hub. This strong performance is underpinned by market depth, liquidity, and robust economic fundamentals. Leading the advisory landscape, CBRE secured a commanding 43% market share in 2025, advising on transactions totaling 2.32 billion euros and marking a record year for its capital markets team.

Premium Office Spaces in High Demand Across Prague

For businesses seeking high-quality office space, particularly in Prague, the market is characterized by strong demand and limited new construction. The office segment proved highly resilient in 2025, with investors showing a clear preference for premium assets in prime locations that meet stringent ESG (Environmental, Social, and Governance) criteria. This trend ensures that available office spaces are increasingly modern, sustainable, and well-situated. Notable transactions, such as the sale of Kavčí Hory Office Park for over 100 million euros – the largest office investment in the Czech Republic in 2025 – and The Square, a 19,000 m² fully leased, high-quality office building, set new benchmarks for the market. Businesses looking for state-of-the-art office environments should be prepared to act strategically in this competitive segment.

Industrial and Logistics Sector Continues Strong Growth

The industrial and logistics segment in the Czech Republic is experiencing significant strengthening, offering ample opportunities for companies requiring warehouse or distribution facilities. The market's robust activity is exemplified by transactions like the sale of the Yanfeng industrial and logistics park in Žatec for nearly 50 million euros, marking the largest sale & leaseback deal in this sector over the past decade. This growth reflects a healthy demand for modern logistics solutions, driven by expanding e-commerce and manufacturing activities. Businesses can expect continued development and opportunities in well-located industrial parks across the country.

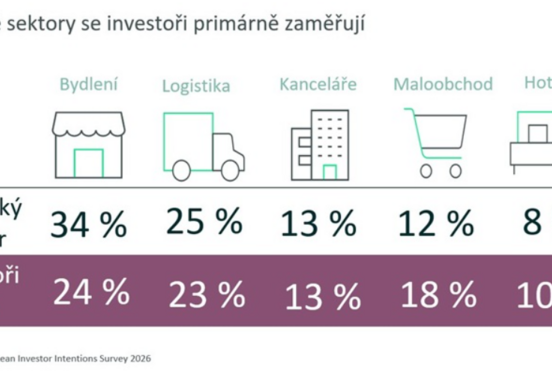

Investor Focus on Quality, ESG, and Prime Locations

A dominant trend across all commercial property segments in 2025 was the clear shift by investors towards quality assets. This means properties in excellent locations, offering stable yields, and crucially, those prepared to meet evolving ESG standards. This focus by investors directly benefits tenants, as it ensures a supply of high-standard, sustainable, and strategically located properties. Domestic investors remained the driving force in 2025, accounting for approximately 80% of total investment volumes in the first three quarters, underscoring the local market's confidence and stability.

Outlook for 2026: Continued Growth and Strategic Opportunities

Looking ahead, investment volumes in the Czech commercial real estate market are projected to remain robust in 2026, exceeding 3 billion euros. Domestic capital is expected to continue as a key market driver. The office segment is anticipated to maintain its resilience, with limited new construction continuing to exert downward pressure on yields for premium offices. The industrial and logistics sector is set for further strengthening. Businesses should also note the expected widening of yield gaps between prime assets in top locations and other properties, emphasizing the enduring value and demand for premium, well-located commercial spaces. This dynamic market presents strategic opportunities for businesses ready to invest in high-quality premises.

Source: cbre.cz