In the fourth quarter of 2023, renegotiations, or the so-called renewal of contracts and lease extensions in existing premises, even reached 60%, i.e. 100,100 m2, of the total volume of completed transactions, which amounted to 166,700 m2 in the same period. "The increase in the share of extended leases is a natural response to the current market situation, where the absence of construction of new office buildings leads to a smaller supply of available space. However, in many cases, it forces companies to work as a temporary solution. Businesses may put off plans to move, but sooner or later they will inevitably have to move. It should be noted that not all buildings can be modernized to meet current growing needs, such as charging stations for electric cars," comments Pavel Novák, Head of Office Agency at Savills.

Subleases

Secondary offer of premises, i.e. the offer from companies offering their already leased but unused premises for subletting increased in the last three quarters in Prague and reached 60,200 m2 at the end of the year. Over 70% of these areas were located in Prague 4 and Prague 5. "Subleases are a solution for companies that have rented more office space than they actually need. Such an offer is at the same time a commodity in demand. The premises are usually at a discounted price, they have a ready-made interior and sometimes furniture, for a more flexible rental period. In this way, they compete with serviced offices, with the only difference being that they do not offer support services like these centers," states Pavel Novák. Savills' autumn survey for February 2023 to September 2023 also confirmed that physical office occupancy (or occupancy) remains at 52% since the pandemic, compared to around 70% before the pandemic.

Reconstruction

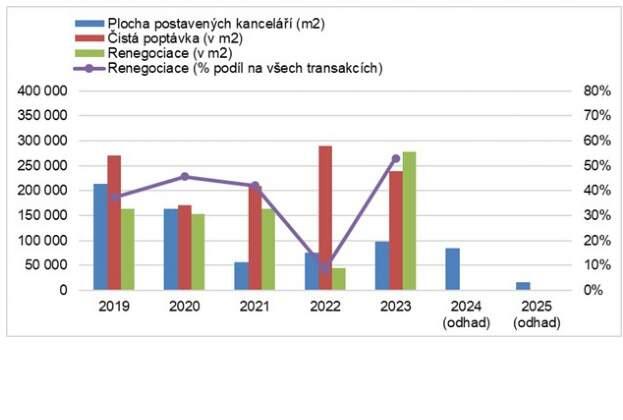

This year, 2024, up to 84,000 m2 of space in ten buildings will be put on the market, six of which are renovations. "A good example of a successfully completed reconstruction is the LIFE_Building_C building in Brumlovka. Following a 2020 upgrade, it has been awarded BREEAM In Use with an Excellent rating, boasts low energy consumption and is currently 90% occupied. We want to point out that the reconstruction of class B and C buildings definitely makes sense," says Pavel Novák, adding: "On the contrary, our data shows that in 2025 the volume of completed construction will fall to the lowest level in the last ten years, and the area of newly built offices will most likely does not exceed 17,000 m2. However, there is still a demand for space on the market, and the opportunity to modernize existing office buildings, which will also be cost-effective in accordance with the ESG strategy, opens up even more.

There is also increased interest in serviced offices (sometimes also coworking centers). There are several reasons why interest in them is growing. Previously, these spaces were mainly sought by individuals, entrepreneurs or startups. Now shared centers are already in demand by larger companies that have from 50 to 100 employees, as well as large corporations for their detached workplaces. “Companies in shared offices get three advantages. The first is that the tenant does not need any investment in the offices, the second is the flexible lease contract and the third advantage is that the tenant does not have to pay for support services that are taken care of by the center operator. As a bonus, they won't get the nasty surprise of arrears on operating cost advances, which a large group of tenants have experienced over the past twelve months. After the pandemic, there was also a shift in the thinking of corporations, where it became clear that they did not have as busy offices as they did before covid. Therefore, flexible lease agreements in serviced offices are more acceptable for them," concludes Pavel Novák from Savills.