According to the analysis of the real estate consulting company Cushman & Wakefield, from which the above-mentioned data come, the total volume of investments in commercial real estate should be around 1.5 billion euros (38 billion crowns) at the end of the year. This would surpass the subdued year of 2020, but at the same time it would still be significantly less than in the years before the pandemic.

"Transaction activity in the Czech Republic is still low, mainly due to the lack of suitable real estate, which is partly due to low construction in all real estate sectors. There is also a discrepancy between what investors would be interested in and what is available on the market, "explains Michal Soták, partner and head of the Cushman & Wakefield investment team in the Czech Republic.

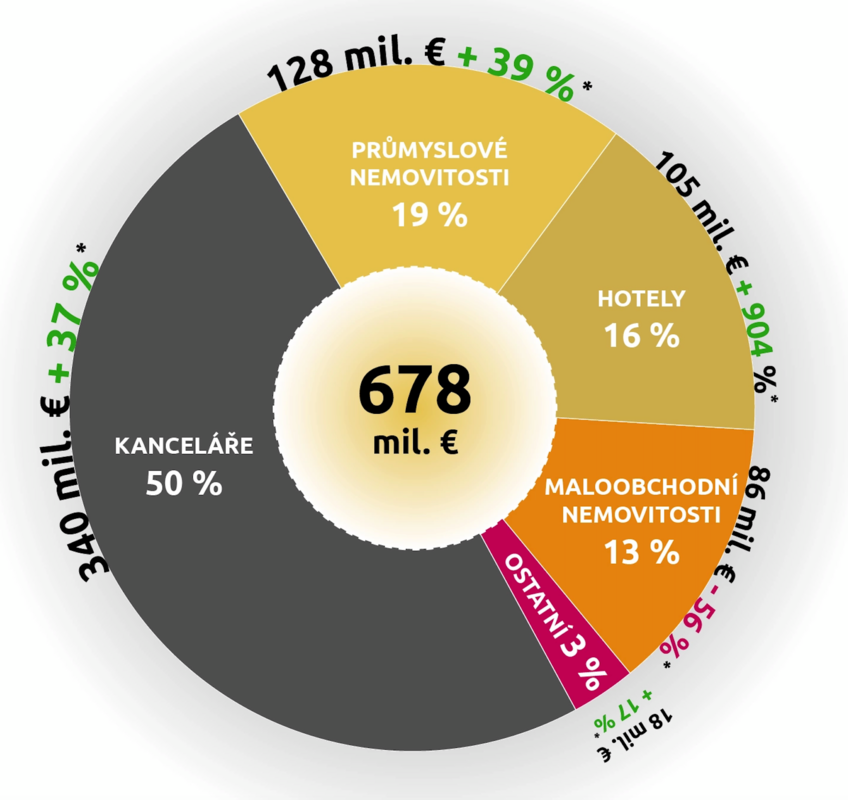

The conclusions he reached with his colleagues also show that investors spent the most on offices in the first six months of this year. They accounted for almost half of the total amount invested, namely 340 million euros (8.7 billion crowns).

At the same time, there were the most transactions in this segment, namely twelve. Among the most important are the sales of Prague's Parkview, Avenir Business Park or Explora Business Center or Nová Karolina Park in Ostrava.

Parkview office building, source: Skanska

"Prices and liquidity of these properties are stable. The Prague market is undersized in terms of construction and entered the coronavirus crisis with record low vacancy, so it should handle any fluctuation in demand very well, "comments Soták.

Almost a fifth of all investments went to industrial real estate, which has enjoyed an extraordinary interest in recent months due to the expansion of e-commerce. About sixteen percent also cut hotels. At the same time, one of the largest transactions of the first half of the year took place in this area - the sale of the W Hotel Evropa on Prague's Wenceslas Square.

Domestic investors had the largest share among buyers in local transactions (43 percent), focusing mainly on offices and retail parks. They were followed by German investors with a thirteen percent share, followed by Israeli and Singaporean investors.

Source: // Forbes