Supply & Vacancy

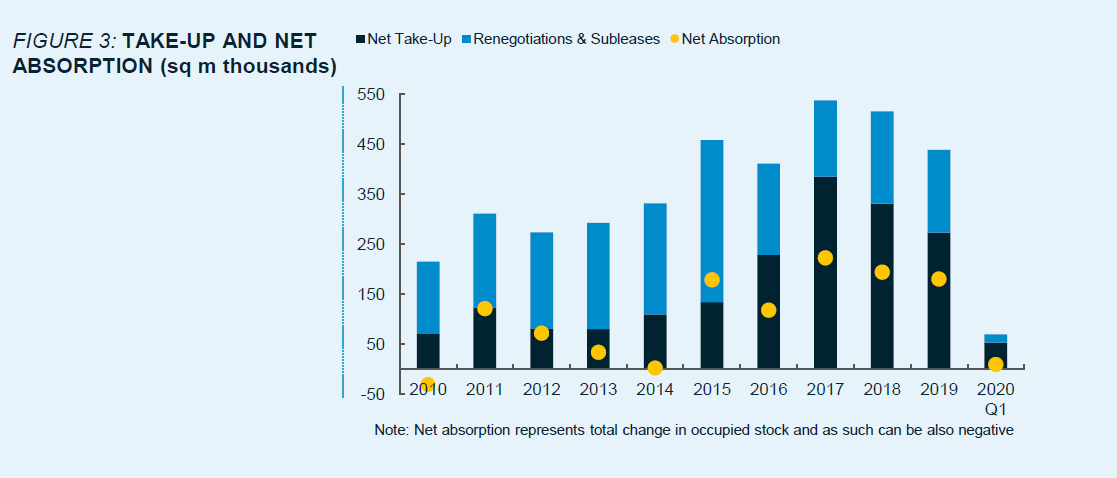

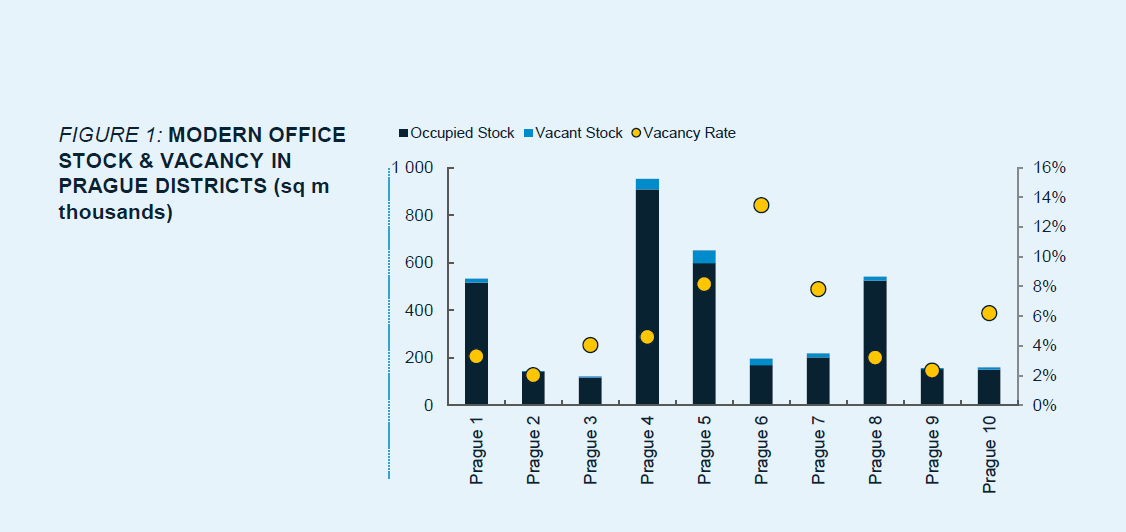

The current volume of modern office stock in Prague is ca 3 67 million sq m In the first quarter of 2020 there were 20 800 sq m of new developments completed On the other hand, a number of obsolete office buildings were removed from the stock, which resulted in a similar total to the end of the previous quarter. The two newly completed developments included, Churchill II in Prague 2 (11 200 sq m) and Kotelna Park Phase 2 in Prague 5 (9 600 sq m). Both buildings were built on a speculative basis, with Churchill II already recording full occupancy and Kotelna Park is fully available to new tenants, which has increased the overall vacancy in Prague 5 and is the highest vacancy from all Prague districts. On the other hand, the overall market vacancy rate dropped by 10 basis points to 5.4 which represents almost 197 300 sq m of available office space. Future impacts of the current crisis should be more visible during Q2 as the most restrictive measures were adopted just before the end of Q1.

Demand

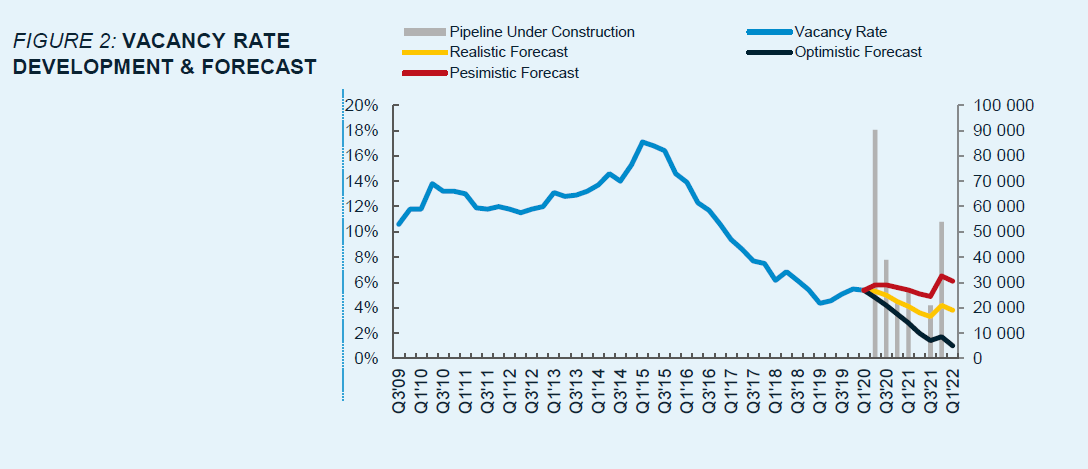

Gross take-up in Q1 2020 reached only 69 600 sq m and was the lowest Q1 result since 2015. Although it is normal that Q1 activity is weaker than fourth quarter each year, the current volume represents a significant 37 decrease Y-o-Y. Net take up totalled 53 500 sq m and is also a decrease of 38 Y-o-Y and 39 Q-o-Q. In terms of net absorption, the market remained in positive numbers at 9 600 sq m. This was mostly possible through a strong level of new deals and fewer new completions. We can expect more interesting developments next quarter, when over 90 000 sq m is due for completion.

Rents

Rents remained stable over the quarter with prime office rents in the City Centre of Prague ranging between 22.50 and 23.50 per sqm per month, with the possibility of some “assets asking for rents nearing 30.00. Inner City prime rent are at 15.00 17.00 and Outer City prime rents are at 13.50-15.00. Despite the market being considered to be on the landlord’s side, we see some aggressive offers from landlords in order to secure as many tenants before the completion of their current projects, pushing the net effective rents to between 10.20 below initial asking rents.

Outlook

Only one office project commenced construction during the first quarter which is the third building of the Harfa project by Kaprain group in Prague 9 (30700 sq m). In combination with other projects nearby, this should add a good portion of stock into this small office district. With over 151 000 sq m planned due for completion in Prague during 2020 we will see how the current crisis will affect both supply chains of building materials and the availability of labour construction workers. Due to these factors, we can expect some projects to be delayed and the future of pipeline projects also carrying some uncertainty. From the current development pipeline, we can expect vacancy to rise a little, mainly from the failure of smaller businesses. Larger international tenants will initially be focused on adapting their workforce and workplaces to reflect social distancing measures as companies slowly start to return to their offices in phases. However, even as the pandemic situation improves, we expect that a good portion of people will continue to work from home or other locations.