The Czech commercial real estate market is undergoing major changes due to coronavirus. What are the current trends and what are the prospects for the office, retail or logistics and industrial real estate segment? According to CBRE's "Mid-Year Market Outlook 2021" analysis, a world leader in commercial real estate services, all of these sectors are showing signs of recovery. In the case of industrial real estate, this year will probably even go down in history as the year with the largest volume of demand on the domestic market. The good news is also that the volume of investments in commercial real estate in the Czech Republic is rising and the interest of international investors remains strong. In addition, the multifamily sector is becoming more and more popular: rental housing products are now among the most sought-after investments in the commercial real estate market in the Czech Republic.

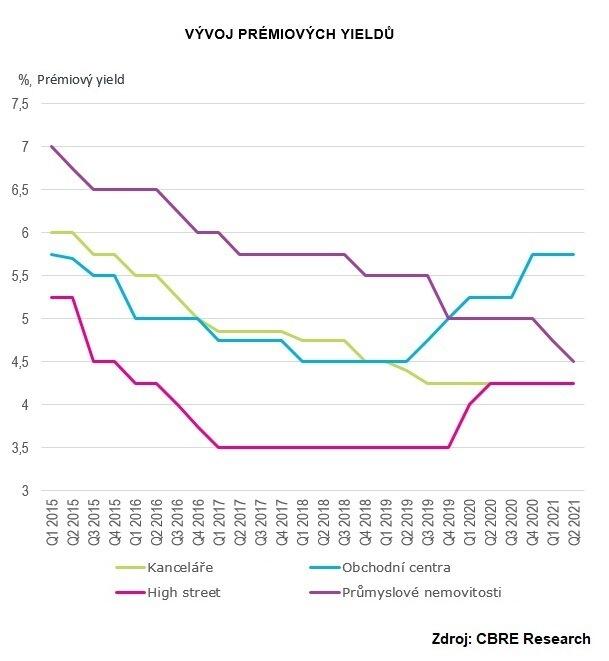

The volume of investments in Czech commercial real estate reached approximately EUR 803 million in the first half of 2021, which is a decrease of approximately 55% compared to the same period last year. However, the volume of investments in 2020 includes the sale of Round Hill Capital's residential portfolio to Heimstaden Bostad for approximately EUR 1.3 billion, which was a very unique and unique transaction on the domestic market. Without it, last year's total investment would have fallen to about 560 million euros - and in this comparison, the values of this year's first half would have already exceeded last year's, which is a year-on-year increase of 43%. We have witnessed a reassessment of investors' strategies, repeated renegotiations of deferred transactions and also the cautious launch of new ones, which can now be seen in the growing volume of closed transactions. The interest of international investors in Czech assets remains strong. The domestic market is established as stable, in high demand - and so far there is no indication that this should change. There is enough capital in the market to respond to different opportunities (so there is no specific focus on just one type of asset, although the pandemic has caused many investors to strengthen their preferences for industrial and logistics real estate). However, investors evaluate very carefully factors such as income sustainability, vacancy or incentives. Among this year's trends, it is worth mentioning the reduction in revenues in the industrial and logistics segment, which is not a surprise, but rather a logical expectation in line with the situation in Europe.

Offices: increased demand from tenants

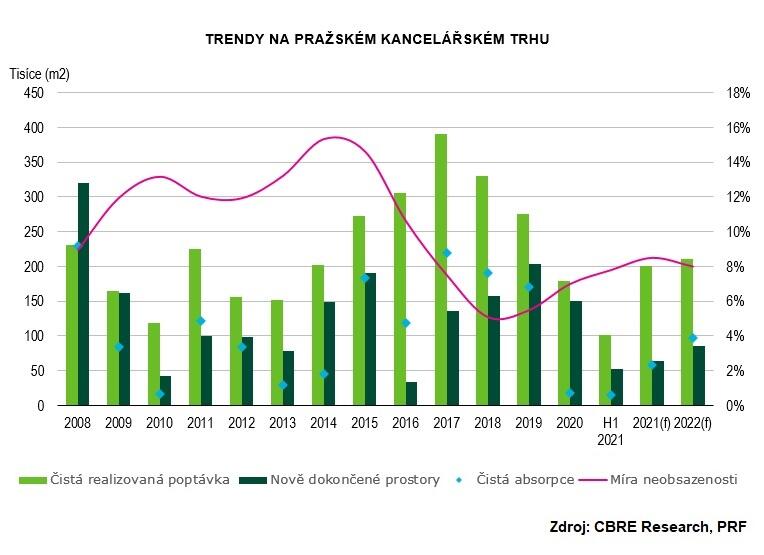

In the last half of the year, 183,300 m2 was leased in Prague, which means a year-on-year increase of 22%. However, the renegotiation of office space dominated the market, 43%, which is a significant increase compared to the 33% share in the same period last year.

In the capital, 53,000 m2 of modern office space in 6 properties was completed from January to June; 75% of them have already been leased. However, the new offer decreased by 40% year-on-year. At present, 147,300 m2 is under construction in 16 projects - of which only 14,600 m2 will be delivered to the market in the second half of 2021. At the end of this year's first half of the year, the prices of premium leases were around 22 - 22.50 euros / m2 / month. According to CBRE's forecast, rental prices in premium locations will remain stable, but downward pressure in less attractive areas could continue. "We are seeing gradual signs of recovery in the office rental market. The largest activity is now shown by small and medium-sized companies with an area of up to 3,000 m2. Larger companies are still assessing their current office needs and are generally more likely to renegotiate their current contracts to achieve more flexible terms. Compared to the period three to six months ago, we are registering a growing demand for high-quality projects in premium locations. Incentives from landlords have increased, while the level of rents has stabilized compared to the onset of the pandemic (when discounts were provided in some cases). For the rest of the year, we expect market activity to continue to increase - provided only that there are no more nationwide lockdowns, "said Simon Orr, CBRE's head of office services.

Retail: the first signs of recovery came in May and June

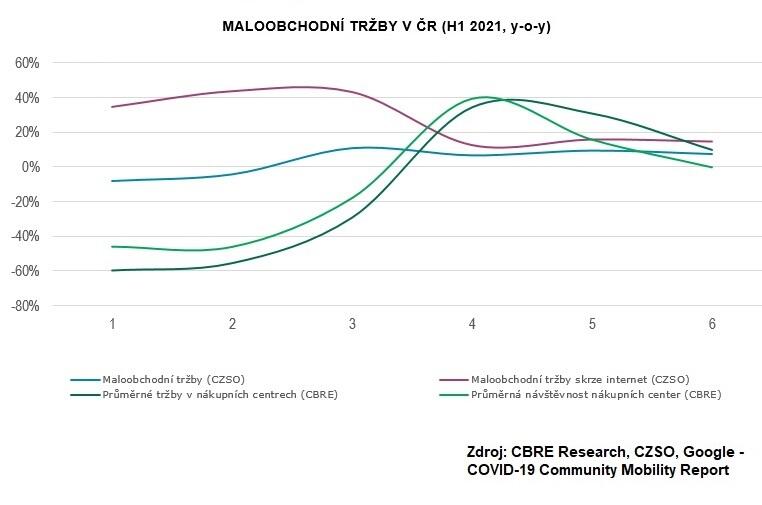

As last year, the retail market was dealing with safeguards imposed by the government, and was hit hard by the pandemic. Although the year-on-year comparison shows a significant increase in sales in Q2 this year, the entire first half of the year resulted in a decline of about 15% compared to last year and a 35% decrease compared to 2019. The first signs of recovery were seen in May and June. According to the Czech Statistical Office, total retail sales in the first half of 2021 increased by 3.6% year on year. "The trend in the change in customer behavior from last year is confirmed, when customers return to shopping centers again after the stores open. This is evident from the turnover of individual stores compared to last year and 2019. Due to the ongoing pandemic and some obligations such as wearing respirators or proving infectivity before entering restaurants or cinemas, attendance still does not reach the level of 2019. Customers plan their purchases in advance and buy purposefully. At the same time, however, they will spend more on their visit than in previous years, "adds Tomáš Míček, head of the retail sector and department of shopping center management at CBRE.

The total area of shopping centers will expand by only 2% next year: now there is only one new shopping center under construction and four are planning to expand. The development of shopping parks is more active, because the domestic market is not yet saturated with them: their total area will increase by about 4% this year. This trend will continue next year - also due to the fact that the concept of shopping parks proved very successful during the pandemic. The market is currently tenant-oriented, as their position in negotiations with landlords has greatly strengthened. The CBRE forecast assumes great pressure on rents and discounts, contributions and flexibility in the length of leases - all until the pandemic subsides sufficiently and the market recovers. We can also expect greater demand for short-term leases (so-called pop-up concepts), where tenants will be able to bridge the period under more favorable business conditions. Some chains will strive to optimize their sales network to increase efficiency and reduce costs.

Trade restrictions and a significant drop in tourism also affected Prague's premium shopping streets (so-called high street): rents fell by 5.4% in the first half of the year, with a further 13% decline expected by the end of the year. Rents in shopping centers of premium locations are similar: in the first half of the year the decrease was 3.4%, a further decrease of 5% is expected by the end of the year. These changes in rents, together with the newly available premises, create the potential for new brands to enter the desired premium locations.

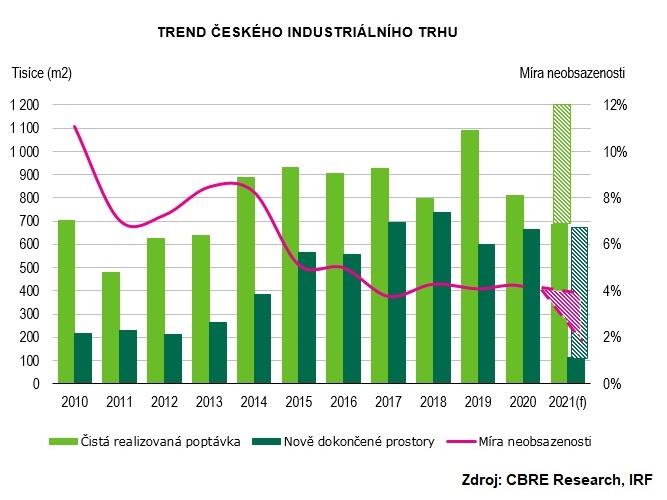

Industrial real estate: a record year is expected

"The industrial real estate market has been very active since the beginning of 2021. Therefore, it is likely that this year will be a record year in terms of newly realized demand. In recent months, however, developers have been facing a complicated situation on the construction market, which brings uncertainty especially to new construction and results in extended delivery times and increased costs, which are slowly beginning to be reflected in rental conditions, "points out Jan Hřivnacký, head of industrial real estate leasing. in CBRE.

In the first half of 2021, almost 690,000 m2 was newly leased, which is only 14% less than for the whole of 2020 (788,800 m2). A comparison of this year's first half of the year with the same period of the strongest year so far (2019) shows an increase in demand of 35% and 60% in terms of total leasing activity. The CBRE forecast predicts that the second half of 2021 will be similar to the first half of the year, as the last quarter is usually the strongest in the year. The main driver of demand in the first half of 2021 were distribution companies mainly from the e-commerce sector (33%), which was accelerated by the pandemic. They were followed by companies focused on the production and logistics of third parties (3PL) with 32%, respectively. 29% share of demand. The typical length of lease for logistics companies remains 5 years, while for production companies it is 7-10 years. And flexibility is coming to the fore: while logistics operators consider short-term leasing to be the most important option, the top priority for manufacturers and retailers is to be able to use temporary storage capacity.

Most of the premises currently under construction are located on the outskirts of Prague, Pilsen and the Moravian-Silesian Region. The share of speculative construction decreased significantly from 30% in the 4th quarter of 2020 to 23% at the end of the 2nd quarter of 2021. CBRE assumes that this year the volume of new construction will remain similar to 2020 (ie 700,000 - 800,000 m2 of new space). The overall vacancy rate is currently only 3% and CBRE does not expect a change next year. Many tenants will need expansion to keep pace with the growing demand for their products or services. The situation is extreme in Prague, where the vacancy rate during 2020 ranged between 1-2%, which did not change during the first half of 2021. According to CBRE, rental prices should not change dramatically this year. The pressure to increase it may arise in the most desirable localities with a low vacancy rate - especially in Prague, where the monthly rent in premium localities rose from 4.90 EUR / m2 in the 4th quarter of 2020 to 5.10 EUR / m2 in the 1st quarter of 2021 and increased again in the second quarter of 2021 to 5.30 euros / m2.

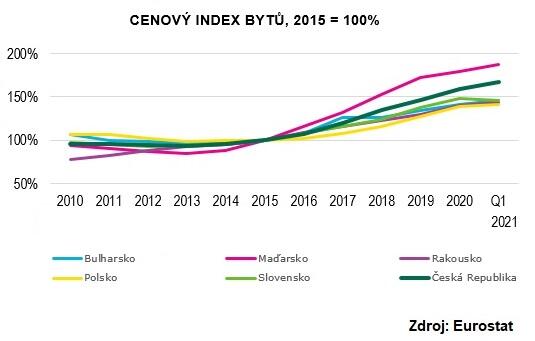

Multifamily sector: expected growth in scope and diversity

Rental housing is on the rise in the Czech Republic and its products are among the increasingly sought-after investments in the commercial real estate market. Demand from institutional investors is growing and investment volumes in the residential sector are usually the second highest after the office segment. In the first half of 2021, transactions worth more than EUR 80 million were carried out in the residential sector, which means almost a 10% share of the total volume of investments in this period. Due to investor interest in assets from the multifamily sector, CBRE expects a slight decrease in prime yields in this segment. In the coming years, the entry of new players into this sector, together with the expansion of existing operators, can be expected to further expand the offer. We can also observe a growing number of cases where the original use of the building changes to multifamily - for example in hotels.